Trends with Foreign Home Buyers in the UK

The United Kingdom, renowned for its rich history, diverse culture, and dynamic business environment, has always magnetised foreign investors. Particularly for those from nations with strong currencies (and economies) like the Emirates, Saudi Arabia, USA, Germany, Switzerland, France, Portugal, and Oman, the allure of the UK property market is undeniable. A crucial factor behind this appeal is the favourable exchange rate for these countries, which financially entices property acquisition in the UK.

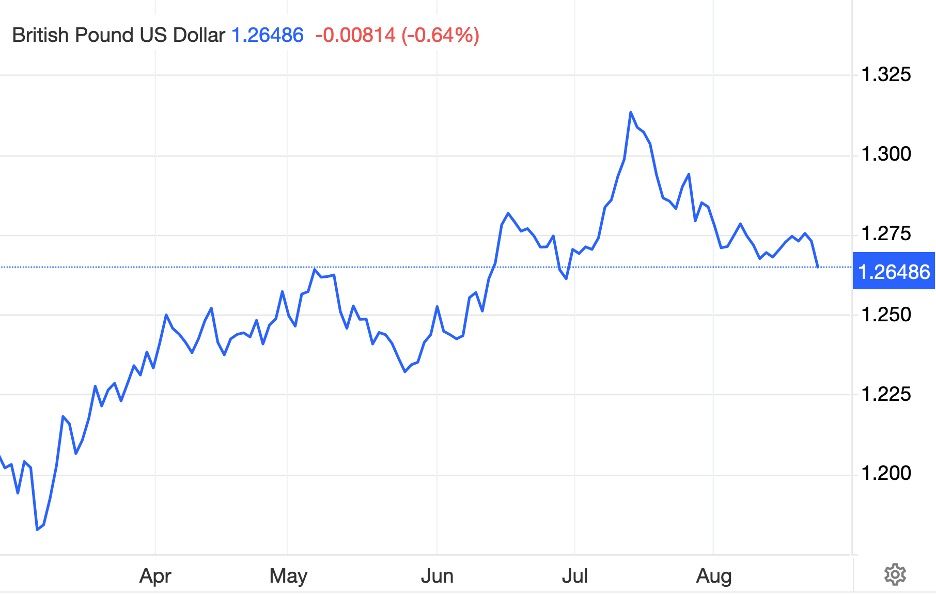

To delve a bit deeper into the dynamics of currency, it's essential to understand the role of forex markets in shaping the decisions of property investors. The fluctuations in currency exchange rates can significantly impact an investor's returns, especially in real estate. A decline in the value of the GBP, for instance, can translate to lucrative opportunities for foreign investors, who might find UK properties considerably cheaper in their native currency.

Here's a snapshot of some key exchange rates heading into September 2023:

- USD-JPY: 145.3000

- EUR-USD: 1.0815

- GBP-USD: 1.2646

- AUD-USD: 0.6419

- USD-CAD: 1.3599

- USD-CHF: 0.8805

- EUR-JPY: 157.1400

- EUR-GBP: 0.8552

- USD-HKD: 7.8402

- EUR-CHF: 0.9523

- USD-KRW: 1,339.6900

Factors such as inflation in the UK, the decisions made by the Bank of England, and geopolitical events can all influence these rates. For instance, a decision by the Bank of England to raise interest rates may bolster the GBP's value, making UK properties more expensive for foreign investors. Conversely, geopolitical turbulence or concerns about the UK's economic future might devalue the GBP, creating a buyer's market for foreign investors.

Given the complexity and dynamic nature of forex markets, potential investors in the UK property market should consider leveraging tools that provide real-time currency insights and facilitate transactions. Here, the importance of choosing the best forex platform cannot be overstated. A reliable platform will offer real-time data and tools to hedge against potential forex risks, ensuring that investors can maximise their returns.

While the UK property market's inherent attractions are many, the intricate dance of currency exchange rates adds another layer of opportunity (or challenge) for foreign investors. Those equipped with the right tools and knowledge benefit most, turning currency fluctuations into lucrative investment strategies.

London is the Most Desirable City in the UK

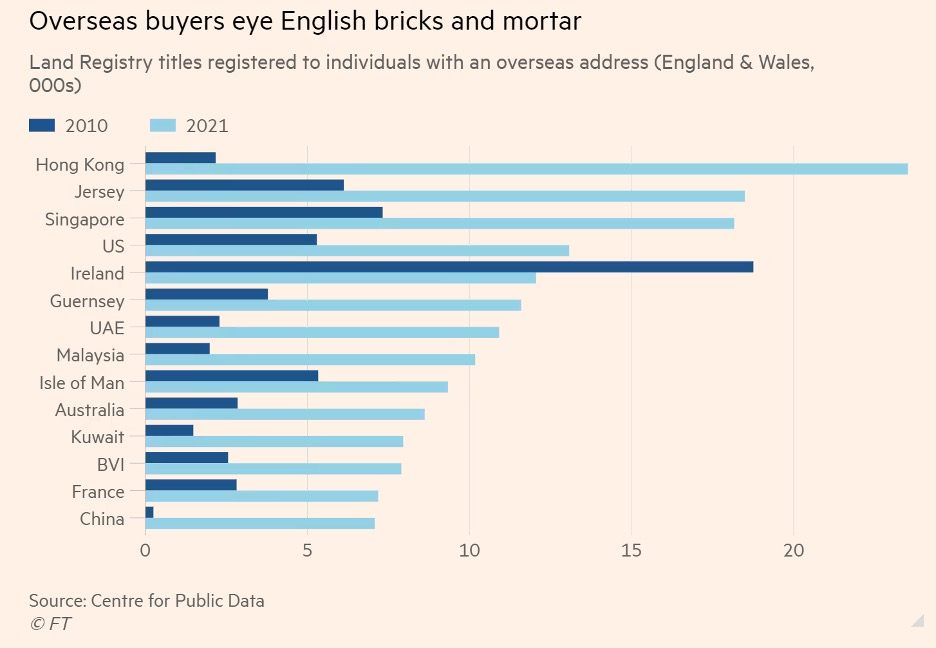

Source: FT.com Land Registry Titles Registered to Individuals with an Overseas Address

Recent research confirms a growing trend of foreign ownership within the UK's real estate landscape. According to a report by Benham and Reeves, overseas nationals own properties in England and Wales worth a staggering £90.7bn. Diving deeper into these numbers, London emerges as the hotspot for foreign property ownership, accounting for properties valued at £45.3bn.

The high-valued areas within London include Westminster (£11.8bn), Kensington and Chelsea (£10.7bn), Tower Hamlets (£3.7bn), Wandsworth (£3.3bn), and Camden (£3.2bn). But it's not just London; other regions like Buckinghamshire, Tandridge, Liverpool, Salford, and Manchester also boast significant values in foreign-owned homes, with Buckinghamshire leading outside the capital at £31.1bn.

Foreign Investors See Value in UK Real Estate

Source: British Pound US Dollar Trading Economics

Such statistics underline the United Kingdom's position as a preferred haven for foreign investors. Despite efforts to moderate foreign interest, overseas buyers play a pivotal role in the property market across England & Wales.

Interestingly, the last decade has witnessed a surge in foreign property ownership. An analysis by the Centre for Public Data revealed that the number of homes in England & Wales owned by overseas buyers has almost tripled since 2010. Concerns have arisen that affluent offshore investors might be sidelining locals due to property price inflation. As of August 2021, UK house prices have swelled to an average of £264,000 from £167,500 at the start of 2010.

Delineating the demographics of these buyers, Hong Kong tops the list, escalating from 2,170 homes in 2010 to 23,524 homes more recently. Singapore, Malaysia, and tax havens like Jersey, Guernsey, the Isle of Man, and the British Virgin Islands are prominent sources of overseas buyers.

Fixed Assets Are Inflation-Beating Investments

Several reasons contribute to this trend. Lucian Cook, head of residential research at estate agent Savills, highlights the global growth in wealth, with investors turning to the stability of physical assets, especially in regions with a sound legal system like the UK.

While London remains a preferred choice for many, the appeal of other cities like Liverpool and Manchester is rising, primarily driven by new developmental projects. Liverpool's overseas ownership has multiplied fourfold since 2010, with nearly 8,000 homes currently owned by international investors.

While the UK has policies concerning foreign ownership, such as tax surcharges, data tracking on individuals needs to be more consistent. The Centre for Public Data recommends that the government introduce a register of beneficial owners of properties linked to overseas companies to enhance transparency. And that’s the story – all under one roof!